Fha Self-employed Income Calculation Worksheet

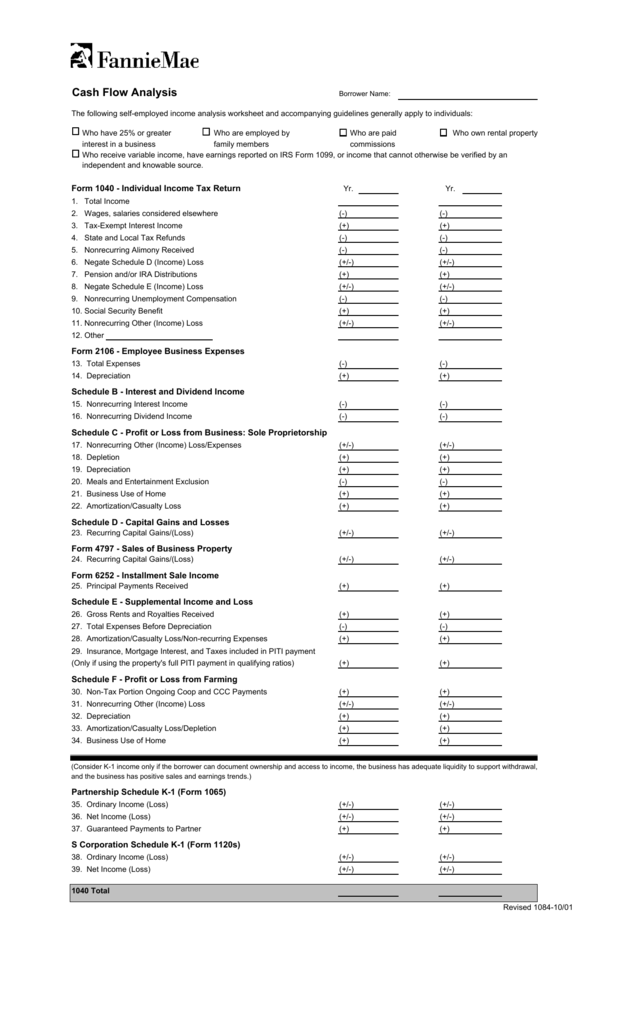

Allowable addbacks include depreciation depletion and other noncash expenses as identified above. Use our PDF worksheets to total numbers by hand or let our Excel calculators do the work for you.

Https New Content Mortgageinsurance Genworth Com Documents Training Course Seb 20form 2091 20part 201 20 2016 20cs 20october 202017 Pdf

But the lender also looks at something else.

Fha self-employed income calculation worksheet. For example say year one the business income is 80000 and year two 83000. This form is a tool to help the Seller calculate the income for a self-employed Borrower. The self-employed income analysis form 1084A or 1084B should be used to determine the borrowers share or a corporations after-tax income and non-cash expenses after obligations that are payable in less than one year have been deducted from the corporate tax returns.

If the Schedule K-1 provides this. To estimate and analyze a borrowers cash. Form 91 is to be used to document the Sellers calculation of the income for a self-employed Borrower.

Keep in mind the underwriter will still make hisher own calculation based on the tax returns in the file. Sharp increases or declines are defined as a 20 percent or greater variance for income earnings from the previous 12 months. Please note that these tools offer suggested guidance they dont replace instructions or.

Cash flow and YTD profit and loss P. Selfemployed borrowers business only to support its determination of the stability or continuance of the borrowers income. Temporarily updating its income requirements for self-employed Borrowers and Borrowers who rely on the receipt of rental income to qualify for an FHA-insured mortgage Additionally FHA is clarifying its guidance for servicing the 203k Rehabilitation Escrow Account for Borrowers who are in a COVID-19 related mortgage payment forbearance.

Other Income YTD income YTD Income Type of income 2106 YTD Expense Estimate 2 year Commission Vs 2106 Expenses Expenses Expense factor W2 income monthly income YTD 1 Year YTD 2 Year Income from 1099 Monthly check or Direct Deposit Income Calculation Worksheet YTD Salary paytsub Past year OT breakout use lowest income average Date W2 for. It is known as a paper loss because it is a non -cash expense. Keep Your Career On The Right Track Our income analysis tools are designed to help you evaluate qualifying income quickly and easily.

Cash flow analysis worksheets for tax year 2020. Increases or declines in self-employed income may require the lender to review additional documentation to support their calculation of annual adjusted and repayment income. INCOME CALCULATION WORKSHEET PART I - INCOME TYPE Section Borrower Co-Borrower 1 Hourly.

A self-employed borrowers share of Partnership or S Corporation earnings can only be considered if the lender obtains documentation such as Schedule K-1 verifying that the income was actually distributed to the borrower or the business has adequate liquidity to support the withdrawal of earnings. Always enter as a positive number. Mortgage notes bonds payable in less than one year Section 53041d.

Thats why Enact provides a collection of downloadable calculators and reference guides to help you analyze a self-employed borrowers average monthly income and expenses. For this reason the amount can be added back to the income subtotal. We get it mental math is hard.

The fact that an FHA mortgage loan applicant is self-employed is not a barrier to loan approval but there are different requirements for those who own a family business or who are considered self employed. Considered self employed and will be evaluated as a self employed borrower for underwriting purposes. Our editable auto-calculating worksheets help you to analyze.

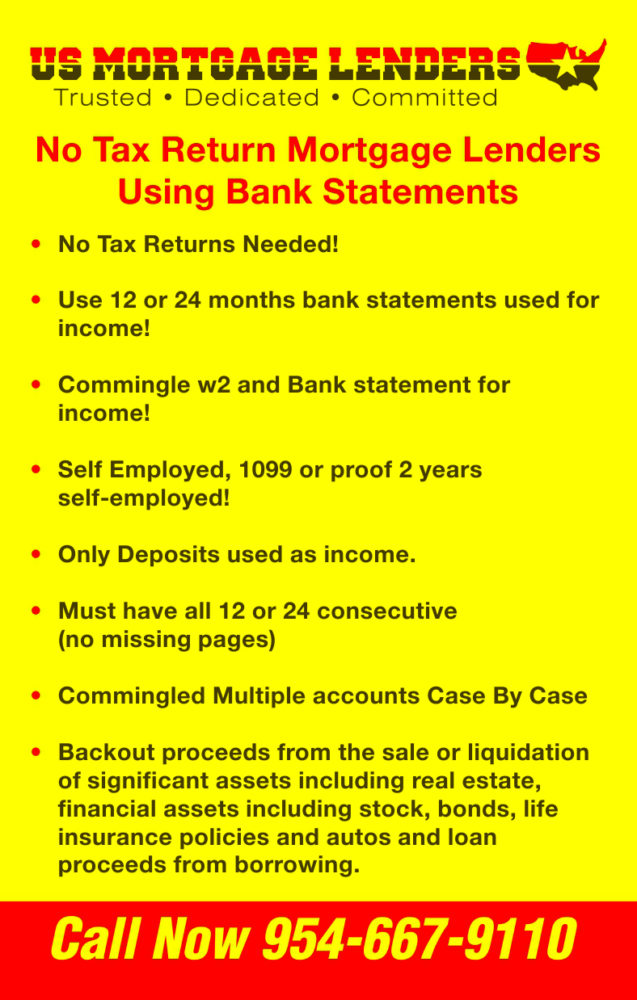

The Sellers calculations. HUD 40001 has rules that govern the procedures a participating FHA lender must use to verify the income of a self employed borrower or owner of a family business. Who receive variable income have earnings reported on IRS 1099 or cannot otherwise be verified by an independent and knowable source.

For self-employed individuals Sole Proprietor Partnership S-Corporation andor C-Corporation you can include a printout of this worksheet in your application to show the underwriter how you figured your clients Monthly Income Average. A typical profit and loss statement has a format similar to IRS Form 1040 Schedule C. FHA Self-Employment Income Calculation Worksheet Job Aid WHOLESALE LENDING d.

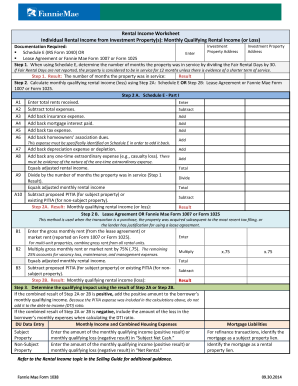

The income used for qualifying purposes is 80000 83000 163000 then divided by 24 6791 per month. Mortgage insurance Step 5 Enter monthly HOA homeowners association dues. Analyze self-employed borrower cash flow income from employment and non-employment sources and rental income using our editable auto-calculating worksheets.

For more information on seasonal employment see HUD 41551 4D2d and HUD 41551 4D2e self employed borrowers and income analysis see HUD 41551 4D4 and the TOTAL Scorecard recommendations see the TOTAL Mortgage. The borrowers percentage of ownership can usually be determined. This self-employed income analysis and the included descriptions generally apply to individuals.

Who have 25 or greater interest in a business. Cash flow analysis worksheets tax year 2020 Self-employed SAM Cash Flow Analysis with PL 02192021 Download the worksheet. Self-Employed Borrower Tools by Enact MI.

Depreciation This field represents the loss in value of assets inves tments etc. See Part II Section 1a 1b 1c or 1d seasonal worker. Income Analysis Worksheet for a calculation worksheet for self-employed borrowers.

Our cash flow analysis worksheets help you to easily and accurately determine a self-employed borrowers income.

Https New Content Mortgageinsurance Genworth Com Documents Training Course Seb 201084 202016 20case 20study 20part 20 20ii 20 20april 202017 Pdf

Http Docs Cmgfi Com Guidelines Cmg Corr 4000 1 Fha Guidelines Pdf

Https New Content Mortgageinsurance Genworth Com Documents Training Course Seb 20sam 20part 20i 202016 20case 20study 20may 202017 Pdf

Section 2 22 The Fha 203b Loan Program 10 31 Stm Partners Manualzz

Hud Qualified Income Mortgage Guidelines For Fha Loans

Https New Content Mortgageinsurance Genworth Com Documents Training Course Seb 20basics 20pt 20i 20final 20oct 202016 Pdf

Fha Loan For Self Employed In 2021 Fha Lenders

Presents Originating Processing Fha Loans Characteristics Of An

Fha Self Sufficiency Test Worksheet Fill Online Printable Fillable Blank Pdffiller

Https Entp Hud Gov Pdf Mp Sfo04 Insapp Pdf

10 Down Georgia Self Employed Mortgage Lenders We Say Yes

Schedule C Income Mortgagemark Com

Https New Content Mortgageinsurance Genworth Com Documents Training Course Seb 201084 202016 20case 20study 20part 20 20ii 20 20april 202017 Pdf

Documents And Tools Chenoa Fund Down Payment Assistance

Fnma Rental Income Worksheet Nidecmege

Correspondent Closed Loan Submission Checklist Wintrustmortgage

Fannie Now Requiring Additional Documentation For Self Employment Income National Association Of Mortgage Processors Namp

Fannie Mae Rental Income Worksheet Fill Out And Sign Printable Pdf Template Signnow

Self Employed Mortgage Options Calculating Self Employed Income

Posting Komentar untuk "Fha Self-employed Income Calculation Worksheet"